Vision: From ADC related deals to current trend

At the end of last year, one striking ADC license deal of $9.5B between Merck and Kelun-Biotech shocked the biopharma industries, boosting again the debates and analysis on the potential market of ADC drugs. Several days ago, Pfizer’s $43B buyout of the leading ADC research industry Seagen has pushed the discussion into a new peak. More and more biopharma companies are actively responding to this boom. BioSeedin has selected 11 from the ADC related deals in the past three months to assist our global partners for future planning in the ADC field.

Among the 11 cases bioSeedin selected, 8 of the deals are aimed to discover new ADC candidates and the next-generation ADC drugs based on the platforms of both sides for new classes of linkers, novel small molecule drugs, new targets and new therapy possibilities. To better illustrate the decisive factors behind these biopharma companies’ action on ADC, let’s look at the case of Pfizer buyout Seagen.

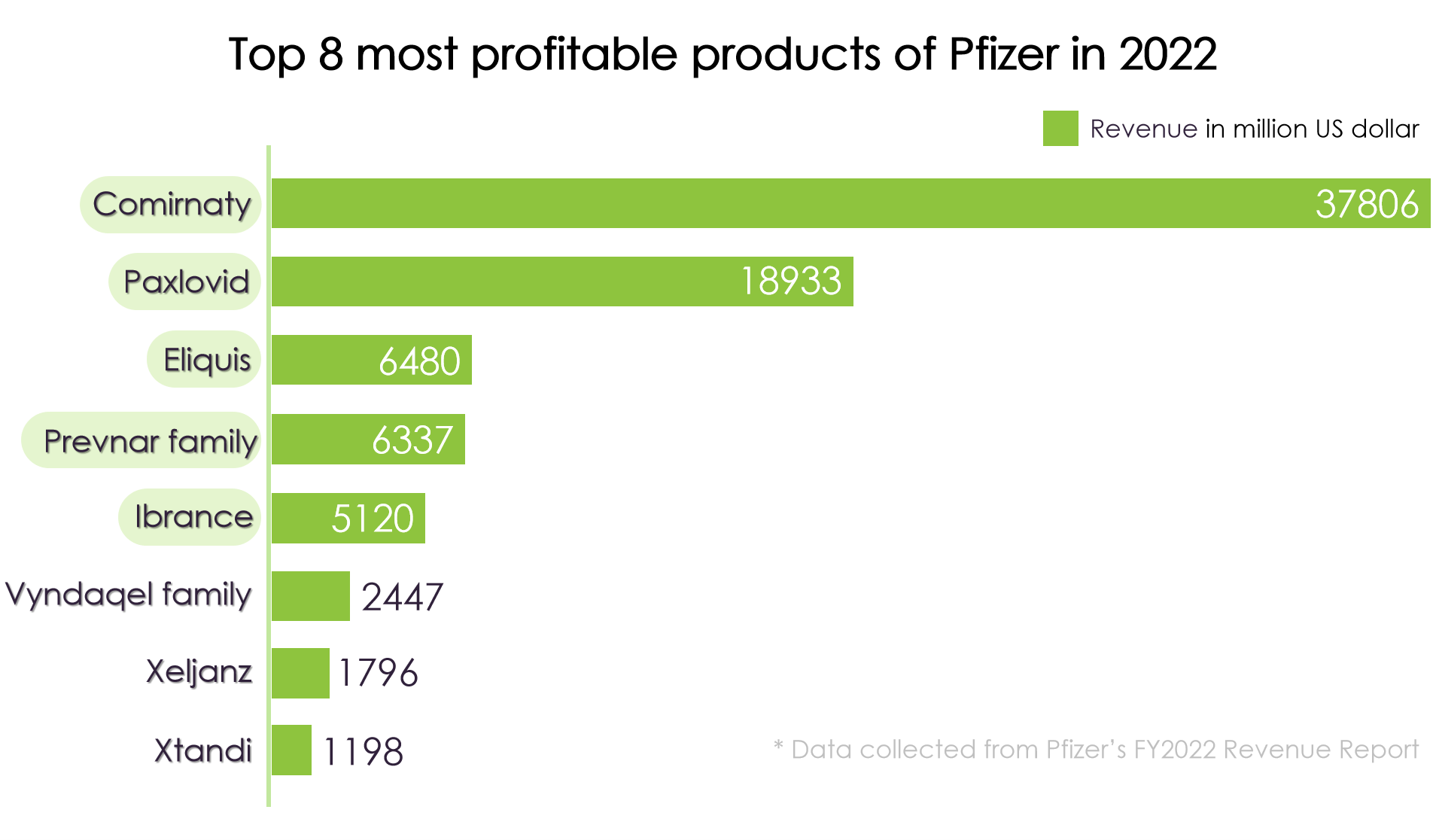

In spite of Seagen’s foreseeable leading role in comprehensive ADC platforms, there are another three reasons for Pfizer choosing Seagen. First is the consideration of the future development of Pfizer Inc. If we look into the top 5 most profitable products of Pfizer in 2022, it is not difficult to find that 4 products would probably lose their market competitiveness in 5 years. Top 2 products, Comirnaty and Paxlovid are COVID-19 related products, while the third Eliquis and the bestseller Prevnar13 in the fourth Prevnar family, will expire the duration of patent right before 2027 according to current rules. If Pfizer still wanted to lead the market, they would either explore new fields, or place their old wine into a new bottle to reserve the patents in another way. Seagen’s ADC platforms can meet both of the requirements.

The second consideration is about time. Time always matters in the biopharma field, especially in innovative drugs. The novel coronavirus pandemic is the powerful proof. Pfizer, as the biggest winner in the COVID-19 related market, has gathered huge global appeal due to that. The edge on the global appeal brings Pfizer many invisible benefits on both the process of marketing and of clinical trials, which would greatly shorten the time and expand impacts of Seagen’s (now Pfizer’s) promising ADC platforms and related products.

The third consideration is the popular feeling. Through Pfizer's buyout of Seagen, the world has seen Pfizer’s determination on battling the diverse types of cancer. For patients, they are likely more prone to try Pfizer’s products because of its brand effect and solid platforms. While for other research institutions or innovative biopharma companies, Pfizer may mean larger and more tolerant cooperator to them. To conclude, one action of buyout Seagen could introduce several aspects of advantages to Pfizer in different levels, and bring about incalculable profits.

Let's go back to the list. Only three of these licensees are trying to expand the pipelines with new potential ADC drugs, in order to catch up with the trend and to prepare for the future prospective innovation. What is worth to notice is that all of the three licensees already have ADC pipelines before, which in the other aspect indicates the competitiveness of ADC drugs. AstraZeneca is a representative company in such deals. The uniqueness of the ADC candidate signed by AstraZeneca reflects on the potential of being an orphan drug. Maybe under the crash of the ‘blood clot’ COVID-19 vaccines, AstraZeneca has returned to its familiar orphan drug field to explore more possibilities in the ADC market and as well to redeem its reputation.

Of all the above discussion, an unavoidable question is coming out: how could different biopharma companies react to the booming ADC market? That answer actually depends on the developing period of the company. As for large comprehensive companies, they are already in the battle of the share in the ADC market, so what they care about most is whether the ADC platforms could expand their existing advantages. But for smaller companies who already have ADC pipelines, maybe it’s better to reanalyze the potential of the existing ADC candidates and then, if feasible, to seek the ADC pipelines with cross-border effects. And for companies that do not have ADC pipelines, ADC candidates with clear MoA, the potential of best-in-class and maybe some patented technology would be a reliable choice.

Besides, more than half of the mentioned ADC licensors are from mainland China, which may indicate that biopharma companies in mainland China have special competitive advantages in the ADC field and are able to meet the different levels of demands in the global market. BioSeedin also has several ADC assets that are able to meet different needs, please check here:

[Trop-2 ADC][IND][Global] Pancreatic cancer, Gastric cancer

[Anti-Her2 II / Anti-Her2 IV Bi-specific antibody ADC][Preclinical][Global] Solid tumor